In today’s fast-paced world, currency conversion is something many of us do regularly, whether it’s for travel, business, or online shopping. One of the most common conversions people look for is from USD to Pound. If you’re someone who’s looking to convert dollars to pounds instantly, this guide will walk you through everything you need to know.

By the end of this article, you’ll understand how to use an online currency converter, why real-time exchange rates matter, and how you can make sure you’re getting the best deal. Plus, you’ll learn some insider tips and tricks to avoid common pitfalls. Let’s dive right in!

Why Use a USD to Pound Converter?

When I was planning my first trip to London, I didn’t think much about converting my dollars into pounds ahead of time. I figured I could just exchange money at the airport. Little did I know, I ended up paying a hefty fee, and the exchange rate was far from favorable. It wasn’t until a friend told me about online currency converters that I realized how much money I could have saved.

An online USD to Pound converter offers real-time rates, so you can make sure you’re getting the most bang for your buck (or pound). It’s simple, quick, and avoids the often excessive fees at physical exchange booths.

Here are the main reasons to use a USD to Pound converter:

- Real-time conversion rates: Stay updated with the latest exchange rates to get the best deal.

- Convenience: Convert your dollars to pounds from anywhere, at any time.

- Cost-effective: Avoid high fees and unfavorable rates at airports or banks.

- Instant results: Get your conversion done within seconds.

How to Convert USD to Pounds Instantly?

Let’s walk you through a simple, step-by-step guide on how to convert USD to pounds online:

Step 1: Choose a Reliable Online Currency Converter

The first step is to select a reliable platform. Not all converters are the same, so it’s essential to choose one that offers real-time exchange rates and low fees. Popular converters like XE, OANDA, and Google’s currency converter are known for accuracy and ease of use.

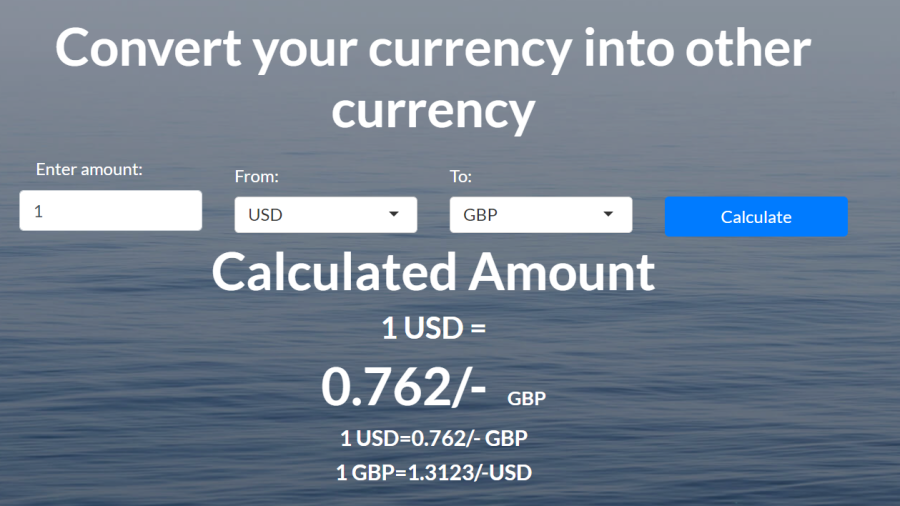

Step 2: Enter the Amount You Want to Convert

Once you’ve chosen your platform, enter the amount of USD you wish to convert. Most converters will give you the equivalent amount in pounds immediately, allowing you to know exactly how much you’ll get.

Step 3: Review the Exchange Rate

Before proceeding, it’s crucial to check the exchange rate. For example, if the rate is 1 USD = 0.76 GBP, this means for every dollar you’ll receive 0.76 pounds.

Step 4: Confirm and Proceed

Once you’re satisfied with the rate, click convert. The platform will instantly display the equivalent amount in pounds. This is particularly helpful if you’re sending money abroad, shopping on UK websites, or simply budgeting for a trip.

Step 5: Keep an Eye on Fees

Though online currency converters often have lower fees than banks or exchange offices, some may still charge a small fee. Always make sure to check for any hidden costs before completing your conversion.

Understanding Exchange Rates

Exchange rates are constantly fluctuating. This is due to several factors, such as economic conditions, interest rates, and market demand for a specific currency. For example, if the US economy is strong compared to the UK, the USD might have a higher value against the GBP.

Here are a few things to keep in mind about exchange rates:

- Live exchange rates are the most accurate, but they change frequently.

- The interbank rate is often the best rate you can get, but it’s usually reserved for large transactions between banks.

- Retail rates or consumer rates are slightly worse than interbank rates due to the small markup platforms use to make a profit.

Why Real-Time Conversion is Important

Imagine you’re shopping for an item online that costs £100. If the exchange rate is 1 USD = 0.75 GBP, you would need to spend around $133.33 to make the purchase. However, if the rate suddenly drops to 1 USD = 0.72 GBP, you’ll need to pay more for the same item.

That’s why using an online currency converter that provides real-time rates is crucial. A delay in conversion could mean spending more than you initially planned.

Benefits of Converting Currency Online

You might be wondering, why not just go to a bank or exchange office to convert your dollars to pounds? Here are several advantages of using an online converter instead:

- Better exchange rates: Online platforms typically offer better rates than physical locations.

- Instant access: Convert from anywhere, without needing to visit a bank or bureau.

- Transparency: Online platforms clearly show fees (if any), ensuring you won’t be caught off guard.

When Should You Convert Currencies Online?

Timing is everything when it comes to currency conversion. Here’s when it’s best to use an online currency converter:

- Before a trip: Whether you’re traveling for business or pleasure, it’s a good idea to convert some money in advance. This ensures you have local currency the moment you land, without worrying about finding an exchange counter.

- While shopping online: If you’re shopping on UK websites, using a converter helps you know exactly how much you’re paying in your own currency.

- Sending money abroad: If you’re sending money to family or friends in the UK, an online USD-to-pound converter gives you a real-time rate, ensuring your recipient gets the full value.

Common Mistakes to Avoid When Converting USD to Pounds

While converting currencies is usually straightforward, there are a few common mistakes that people make:

- Ignoring fees: Some platforms add hidden fees after the conversion. Always double-check the terms before you proceed.

- Not checking the rate: Exchange rates fluctuate constantly. Failing to check the latest rate can mean losing out on a better deal.

- Rushing the process: While it’s tempting to convert quickly, waiting for the right rate can sometimes save you significant amounts.

Conclusion: Make Currency Conversion Simple and Profitable

Using an online USD to Pound converter is the quickest and most efficient way to ensure you get the best rates without unnecessary hassle. Whether you’re a frequent traveler, an online shopper, or someone who sends money internationally, this tool can save you t