In the realm of molecular biology and genetic engineering, Tn5 Transposase is a powerful tool that has revolutionized the way we manipulate and study DNA. It’s like molecular scissors and glue combined, allowing us to precisely cut, move, and insert DNA sequences. In this article, we will unravel the wonders of Tn5 Transposase, its applications, and why it’s an indispensable asset for researchers and biotechnologists.

What is Tn5 Transposase?

Tn5 Transposase, a protein derived from the bacterial transposon Tn5, belongs to the DNA transposase family. Transposons are segments of DNA that can move around in the genome, and Tn5 Transposase plays a vital role in this process. It works like a pair of molecular scissors, cutting DNA at specific recognition sequences, and then acts as a glue to integrate the DNA into another location. This allows researchers to insert or delete specific DNA sequences with great precision.

Applications of Tn5 Transposase

DNA Sequencing: Tn5 Transposase is a fundamental component in various DNA sequencing methods, such as Next-Generation Sequencing (NGS) library preparation. It simplifies the process of fragmenting and tagging DNA, making it easier to sequence and analyze.

Genomic Engineering: In genome editing, Tn5 Transposase can be used to introduce specific genes or regulatory elements into an organism’s genome. This is a valuable tool for creating genetically modified organisms (GMOs) and studying gene function.

DNA Cloning: Tn5 Transposase is used in the construction of DNA libraries, facilitating the generation of plasmid and cosmid libraries. These libraries are crucial for storing and retrieving specific DNA sequences.

Transposon Mutagenesis: Researchers utilize Tn5 Transposase to create mutant libraries by randomly inserting transposons into an organism’s genome. This helps identify genes involved in various biological processes.

Protein Expression: Tn5 Transposase can assist in the integration of protein expression cassettes into host genomes, allowing the production of recombinant proteins for various biotechnological applications.

The Power of Precision

Tn5 Transposase’s greatest strength lies in its precision. It recognizes specific DNA sequences, called inverted repeats (IRs), and cleaves the DNA precisely at these sites. This allows for controlled DNA movement and integration, minimizing the risk of disrupting essential genes or regulatory regions. Such precision is a game-changer in genetic research, ensuring that the desired changes are made without unintended consequences.

Working with Tn5 Transposase

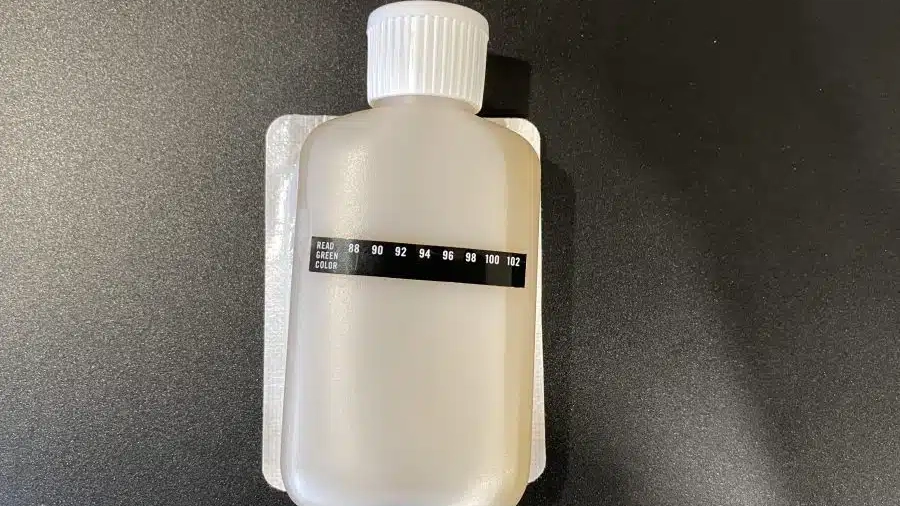

Researchers can obtain Tn5 Transposase from reliable sources like Creative Enzymes. It is typically supplied in a ready-to-use format, making it user-friendly. The process involves mixing the transposase with the DNA of interest and incubating the mixture under controlled conditions. The result is efficient and precise DNA manipulation.

Conclusion

Tn5 Transposase is a remarkable tool in the field of molecular biology and genetic engineering. Its precision and versatility have opened up a world of possibilities for DNA manipulation, sequencing, and genetic research. Whether you are a seasoned researcher or just beginning your journey in this field, Tn5 Transposase is a valuable asset that can simplify your work and expand your scientific horizons. Embrace the magic of Tn5 Transposase and unlock the secrets of the DNA world.

Source from Creative Enzymes

Creative Enzymes uses its expertise in enzyme manufacturing to supply customers enzymes using for life science research and production of medicines, food, alcohol, beer, fruit juice, fabric, paper, leather goods, etc.

Our products are used worldwide in academic, commercial, and government laboratories in diverse applications, including basic research, drug discovery, cancer research, infectious disease research, microbiology, and personalized medicine. As a reliable supplier, Creative Enzymes supplies the products of high quality and competitive cost-effectiveness. We cooperate with a large number of satisfied customers in corresponding fields all over the world.

Creative Enzymes is customer-oriented. Our staff always devote themselves to provide quality products and considerate services to the customers. Some of our products are also unique in the field. Choosing our products means choosing high return.

For further development, Creative Enzymes warmly welcomes related researchers to contact us for exploiting new enzymes together.